Posted by PrimeTrust Advisors | January 26, 2024

Seeking Fiduciary Protections

Two Strategies for Protecting Yourself as an ERISA Fiduciary

Background

If you are a fiduciary of a 401(k) plan, here’s a thought to seriously ponder.

By rule, your default position as an ERISA fiduciary is that YOU are personally liable for claims of investment losses incurred by participants for their investment decisions…

That is, UNLESS you are exempted from the standard rule by securing the fiduciary protections of ERISA Section 404(c).

Now don’t be too quick to jump to the assumption that you are exempt because you have “checked the 404(c) box”. There is widespread misunderstanding of 404(c) throughout the retirement plan community. More on that shortly under Securing 404(c) Investment Protections.

“The courts will judge a fiduciary on the process that was followed in managing investment decisions—not on the ultimate investment results.”

Secondly, ERISA fiduciaries—meaning YOU—are also liable for performance results of the Plan’s investment options…

That is, UNLESS you can provide documented evidence supporting the prudent selection and monitoring of those investment options.

“The courts will judge a fiduciary on the process that was followed in managing investment decisions—not on the ultimate investment results.”[i] [Emphasis added.]

You might be saying to yourself, “Well, that sounds rather abstract and ambiguous, how might our process be judged? How would I know if I’m at risk here? Are there standards by which we would be judged?”

Fortunately, the answer is yes! There are standards, but more on that in a minute under Implementing a Prudent Investment Management Process.

The purpose of this article is to highlight and emphasize the value of fully implementing these two strategies to fully capture the protections afforded by them.

We also will speak to common misunderstandings related to these strategies that frequently lead people astray and remaining exposed to the risk they were attempting to avoid.

Strategy 1- Securing 404(c) Investment Protections

A common misunderstanding is 404(c) provides far greater fiduciary protection than it actually does. The protections are limited to liabilities stemming from any claim of a breach related to a participant’s selection of investments and are only available if the checklist of 404(c) requirements is actually satisfied. Considering what is at risk, that is worth verifying. After an investment loss has occurred, no investment fiduciary wants to learn that—because of disclosure failures—404(c) protections are NOT available.

The good news is that essentially all the disclosure requirements under 404(c) are replicated by the Department of Labor’s mandatory 404(a)(5) fee disclosure requirements. That shifts the verification matter to an investigation into whether your Plan’s service provider(s) are adequately delivering the required disclosure items to participants on a timely and accurate basis.

The beginning of the year is an opportune time to meet with your Plan’s service provider(s) to ensure that the requirements are being satisfied. Enter your email to request the checklist of the requirements to help you with the inquiry.

Request your FREE checklist

Strategy 2- Implementing a Prudent Investment Management Process

ERISA requires fiduciaries to discharge their duties with respect to selecting and monitoring investments of an ERISA plan “with […] care, skill, prudence, and diligence”[ii]. Failure to do this leaves fiduciaries exposed to liability resulting from underperforming investments and high-fee claims—areas NOT protected by 404(c).

It is our observation that fiduciaries generally need to “up their game” in this area.

Again—even within our industry—there exists a misunderstanding of the law’s intents and purposes for mandating a prudent investment management process. Such misunderstandings often lead decision-makers astray, leaving them exposed. The central aim of the prudent process is to ensure that fiduciaries make well-informed and reasoned investment decisions.

I overheard an investment advisor recently say that investment returns are the only thing that really matter. His conclusion being that identifying and selecting those investments which provide the highest returns is the only thing that really matters. The emphasis of his “process” is squarely placed upon past performance results. That’s his measure of success. This is misguided and misses the point entirely. Actually, many people miss this same point.

Here’s the point, fiduciaries will NOT be judged on investment performance results; they will be judged on the substance of their decision-making process. Read that again.

“The court’s inquiry must focus on the quality of the fiduciary’s investigation of an investment, not the merits or ultimate performance of the investment.”[iii]

Therefore… “At a minimum, plan fiduciaries must engage in a thorough and diligent investigation and analysis, and perhaps bring in expert advisers, before making a decision.”[iv]

Instituting a strong prudent management process is like playing the 404(c) card. It protects you. Without it, you are at risk.

Think about where this might be relevant today. In a world where we are bombarded with news and hype surrounding new investment products—think Crypto, ESG funds, etc.—being strongly marketed to 401(k) plans, fiduciaries must be intentional about instituting a prudent selection process for considering such investments before just adding them to the investment menu simply because they are available.

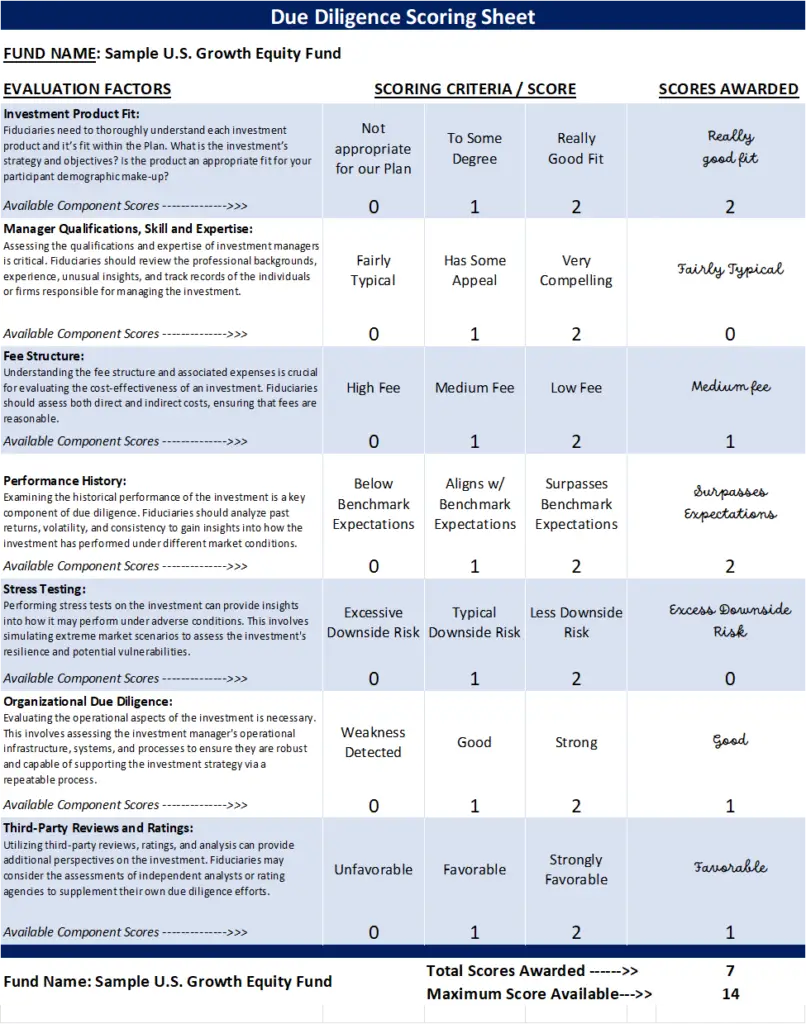

What might a prudent investment selection process look like? Check out the sample due diligence worksheet below. Thorough due diligence is the key. You can do this, or you can hire an advisor to conduct this level of due diligence for you; or remove yourself from the process and legally delegate the responsibility (and liability) to the advisor altogether.

Does your gut inform you that a prudent due diligence process similar to the one above is being followed at your organization? We would respectfully suggest that if the selection and monitoring process of investment managers is centered mainly on historical rates of returns and you are not retaining documentation of the reasoning behind your decisions (to select, replace, or retain certain investment funds), you may be lacking the fiduciary protections you will need in the event of a claim for underperforming funds. Remember, it is about the process, not the results.

Conclusion

While the narrative of this article is framed in the context of protecting you as a fiduciary, the real aim of instituting these protections is to foster a better plan for 401(k) plan participants by promoting better communications and disclosures to employees and to provide a solid decision-making framework for fiduciaries… leading to better overall performance for the Plan and employees on their journey toward financial well-being.

This article is provided for informational purposes only. It is not intended to provide authoritative investment or legal advice. You should consult your own attorney or investment advisor for guidance on your particular situation.

[i] The Management of Investment Decisions by Donald B. Trone, William R. Albright, and Philip R. Taylor

[ii] ERISA Section 404(a)(1)(B)

[iii] Donovan v. Cunningham, 716 F.2d 1455, 1467 (5th Cir. 1983)

[iv] A Prudent Process Protects Fiduciaries by Eric D. Altholz