Posted by PrimeTrust Advisors | February 9, 2024

The Power of Intelligent Decision-Making In Financial Planning

Introduction

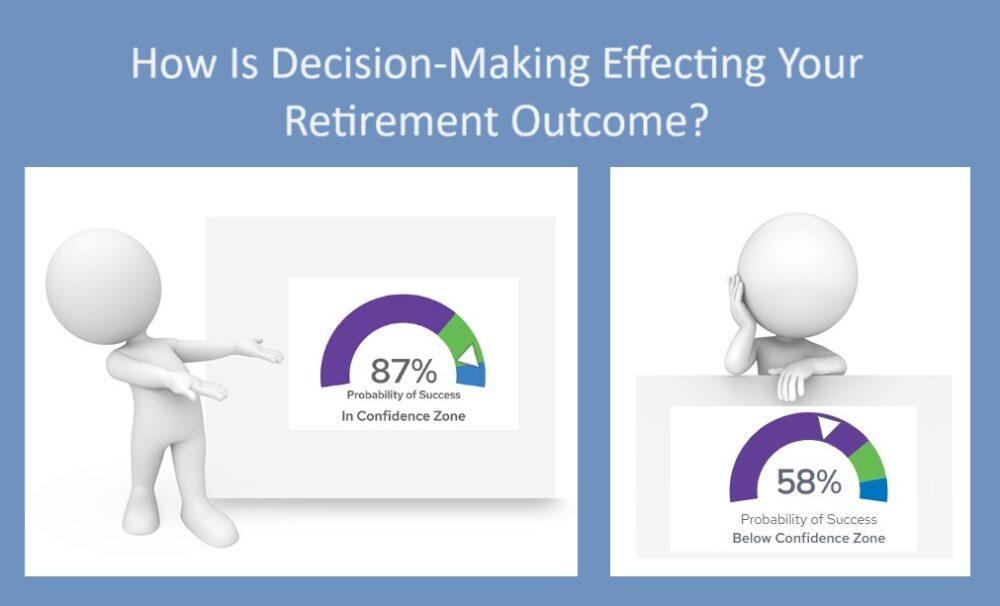

Picture two individuals, identical in age and income, with matching financial resources—IRAs, 401(k), pension, Social Security, investments, and more. Despite these similarities, these individuals are likely to experience vastly different outcomes in their retirement.

How can that be? The answer lies in their decision-making and the methods used to arrive at those decisions.

Unfortunately, many people just “wing it”.

Others harness the power of intelligent decision-making by methodically testing the benefits and features of their financial resources to identify their best choice.

So, it’s the methods used in decision-making that sets these two individuals apart.

This article highlights the power of harnessing intelligent decision-making into a strategic planning process… a process that aims to maximize the effectiveness of each of your financial resources.

The Decision-Making Challenge Lies in the Complexity of Choices

Think about it… for every financial resource that you have—be it Social Security, 401(k), etc. — there always exists a subset of choices… requiring a decision for the choice that best fits your preferences.

Complexity of choices leads many Americans to look for short-cuts by tapping into easy and quick answers from friends, acquaintances, and internet sources. However, what works for one might not work for another due to circumstances. There are very likely several factors in your life that are not applicable to your friend which would dictate a “better” approach for you.

Harnessing the Power of Intelligent Decision-making

The key to tapping into effective decision-making lies in leveraging professional guidance. Attorneys, accountants, or financial advisors can streamline the process for you. Identifying someone who is already well-versed in the choices you face will save you time and guide you to make intelligent decisions. They should possess the tools for leading you through a methodical process of testing your array of decisions with an aim of arriving at a combination of decisions that will most favorably influence your outcome for retirement.

Intelligent Decision-making Takes a Holistic Approach

When considering your choices, take Social Security for example, when is the best time to claim retirement benefits… Age 62? Full Retirement Age? Age 70? And… when should my spouse claim??

Would-be retirees often make that decision in isolation.

Rather than evaluating options in isolation, consider how they interact with other resources like pensions or 401(k)s. Could delaying Social Security payments and using other funds to bridge the gap lead to better outcomes? Any such strategies need to be tested to assess which decision best fits your situation. This holistic evaluation maximizes benefits across the board.

Conclusion

In the world of retirement planning, identical financial resources do not guarantee similar outcomes. The key lies in the methods used to arrive at decisions made regarding each component of one’s financial portfolio. Whether it’s Social Security or a 401(k), the impact of well-thought-out decisions cannot be overstated. The importance of seeking professional guidance for a tailored plan, ensuring that every decision aligns with an individual’s unique circumstances improves your odds of favorable retirement outcomes. Click here to see a short 3-minute video of what the strategic planning process looks like.

This article is provided for informational purposes only. It is always best to counsel with your financial advisor or your tax professional to ensure that you make the best decision for your circumstances.

We’re Here to Help

If you have questions or want to explore this further, you can schedule a call with us using the calendar.

Or… you can do it the old fashion way by calling us directly at (864) 552-4020. We would welcome your call.