Posted by PrimeTrust Advisors | June 10, 2024

Your 401(k) Checkup

By: Chip Hunt and Jamie Hunt

It’s a good idea to conduct a regular checkup

Since your 401(k) plan is not a “set it” and “forget it” program, it’s a good idea to conduct a regular checkup to assess the health of your retirement accounts. While we are primarily talking about your 401(k) account, for purposes of this assessment, you should include all your retirement accounts; including any IRAs, old 401(k) accounts, spousal accounts, and any other accounts you have earmarked for retirement.

Just as your doctor uses certain measures (blood pressure readings for example) that serve as guidelines for assessing your health, below we provide you with measures that you can use to assess the health of your retirement savings.

This checkup should be easy for you… we will not have to draw blood, but it could cause you to feel a bit queasy.

Let’s go through this checkup together to ensure you’re setting yourself up for a bright retirement future.

1. Checking Your Contribution Levels:

Prescribed Normal Range: 10% – 15%

Don’t make the common mistake of contributing only enough to get the full employer matching contribution. You will most likely need more than that to fund your retirement.

To be clear, the 10% to 15% contribution range that we recommend – that’s 10% to 15% of combined household income, so families with dual incomes each need to contribute at these levels.

The good news is that if your employer is also kicking in a 4% match, you each will only need to contribute in the 6% to 11% range. It’s worth noting that some companies make contributions in addition to matching contributions – usually in the 3% range. If you are so lucky, that contribution would further reduce the amount you would need to contribute.

2. Checking the Health of Your Existing 401(k) Balance:

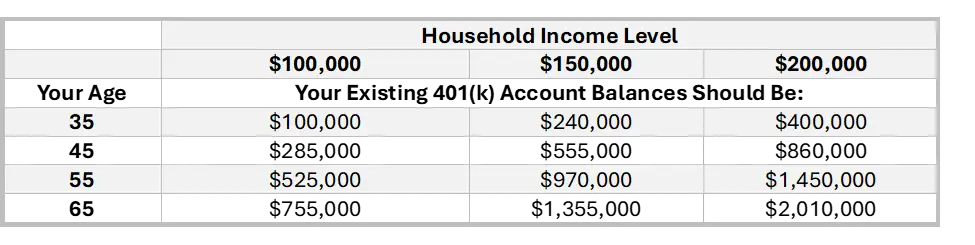

The chart below serves as a good indicator of the sufficiency of your existing savings balance for families at different household income levels. These prescribed balances assume 10% future household contribution rates to support the account growth needed by retirement age. These are general ranges, to personalize your plan, use your 401(k) service provider’s online calculator or work with a fiduciary investment advisor to help you assess your situation.

Prescribed Normal Ranges:

How to read the Chart:

- Go to the intersection of your age and closest household income level.

- This is the amount you should have already accumulated in your accounts.

Example: A 45-year-old with household income of $100,000 should have current savings of $285,000.

3. Checking the Health of Your Investments:

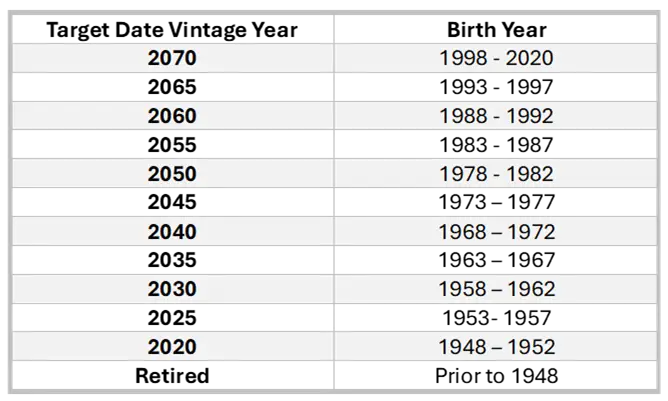

Unless you are an investment professional, the best advice I can offer most individuals is to let the professionals do the work for you. Your plan’s target date series of funds is the most effective, efficient, and cost-effective way of accessing professional investment management. These are mutual fund products that are pre-constructed, diversified portfolios that regularly adjust your underlying investment mix to systematically reduce market risk as you approach retirement age. It is worth knowing that you should be able to also access target date funds for your IRA on most custodial platforms. If not, now is the time to change.

Prescribed Normal Range: Age-Appropriate Target Date Fund

The chart below identifies which target date vintage year you should invest based upon your year of birth. For example, someone born in 1960 should invest in the Target Date 2030 fund.

4. Checking the Security of Your Accounts:

Most investors worry about losing money due to market risk, but without proper safeguards in place, you could lose money in your accounts due to theft. Online theft is on the rise and getting even more sophisticated with AI technologies.

Most 401(k) service providers offer protections against online theft to participants who go online with their 401(k) provider and set up prescribed safety protocols. Not taking the time to set up safety protocols with your 401(k) service provider is like leaving the front door of your home unlocked when you turn in for the night.

5. Checking the Status of Your Beneficiary:

One man’s ex-girlfriend – they broke up in 1987 – stands to get his $1 million retirement account because he never changed his beneficiary designation, and he has now died according to a recent article in the Wall Street Journal. “The battle over [his] money is a stark reminder that the beneficiary forms on retirement accounts, life insurance policies and bank accounts matter. In most cases, they trump the will even if they were filled out decades prior”. 1

Ensure that your account is passed on to the person you intend

Life is full of changes, and it’s essential to review and update your beneficiary designation regularly to reflect any significant life events such as marriage, divorce, the birth of a child, or the passing of a loved one.

Ensure that your account is passed on to the person you intend. This is a very common mistake for many who do not have any beneficiary designation on file. Be sure to take care of this!

Checking Out

With this checklist in hand, you should now have a pretty good assessment of your situation. If you have questions, don’t hesitate to reach out if you need further guidance. Together, we can make sure you’re on the right path. To schedule time to speak with Chip and Jamie, click a date on the calendar.

- Ebeling, Ashlea. “Personal Finance – His Ex Is Getting His $1 Million Retirement Account. They Broke Up in 1989.” The Wall Street Journal, 8 June 2024, www.wsj.com/personal-finance/inherited-retirement-savings-beneficiary-breakup-divorce-849e3ff2.

↩︎